Why some of us should review our way of working

Data and analytics are pivotal in risk management, capable of shaping business outcomes, whether for better or worse. Within the telecom sector, while certain revenue assurance projects adhere to the latest sophisticated risk management practices, others tend to repeat common mistakes. They often focus too heavily on highly technical risk management with a strong emphasis on data analytics technology, isolating it from the broader organization's daily activities.

It is no secret that many risk management programs fail because they do not connect well with specific business goals or consider the broader business context. This issue is not unique to revenue assurance; it is a frequent problem across many different enterprise programs. How often have we come across alarming tales of billing, network, or CRM (Customer Relationship Management) implementations gone wrong in the telecom industry? Effective risk management should take a project management approach, involving multiple teams working together towards a shared goal. It is not easy when different teams have different objectives, priorities, tools, or face communication breakdowns, which lead to project failure or inefficiency.

While technology continues to play a growing role, revenue assurance practices have remained integral to a telecom's overall risk culture. However, at times, there is an excessive emphasis on collecting and validating transactional data, assigning it more weight in the overall process than it should within the overall risk management context.

Technology is undoubtedly powerful, but it can't capture all aspects of human insights and experiences. It's essential to remember that technology can enhance processes, but the human touch, including creativity, intuition, empathy, and critical thinking, remains invaluable for a comprehensive understanding of complex issues and human dynamics, regardless of whether you're in a risk management or data management team.

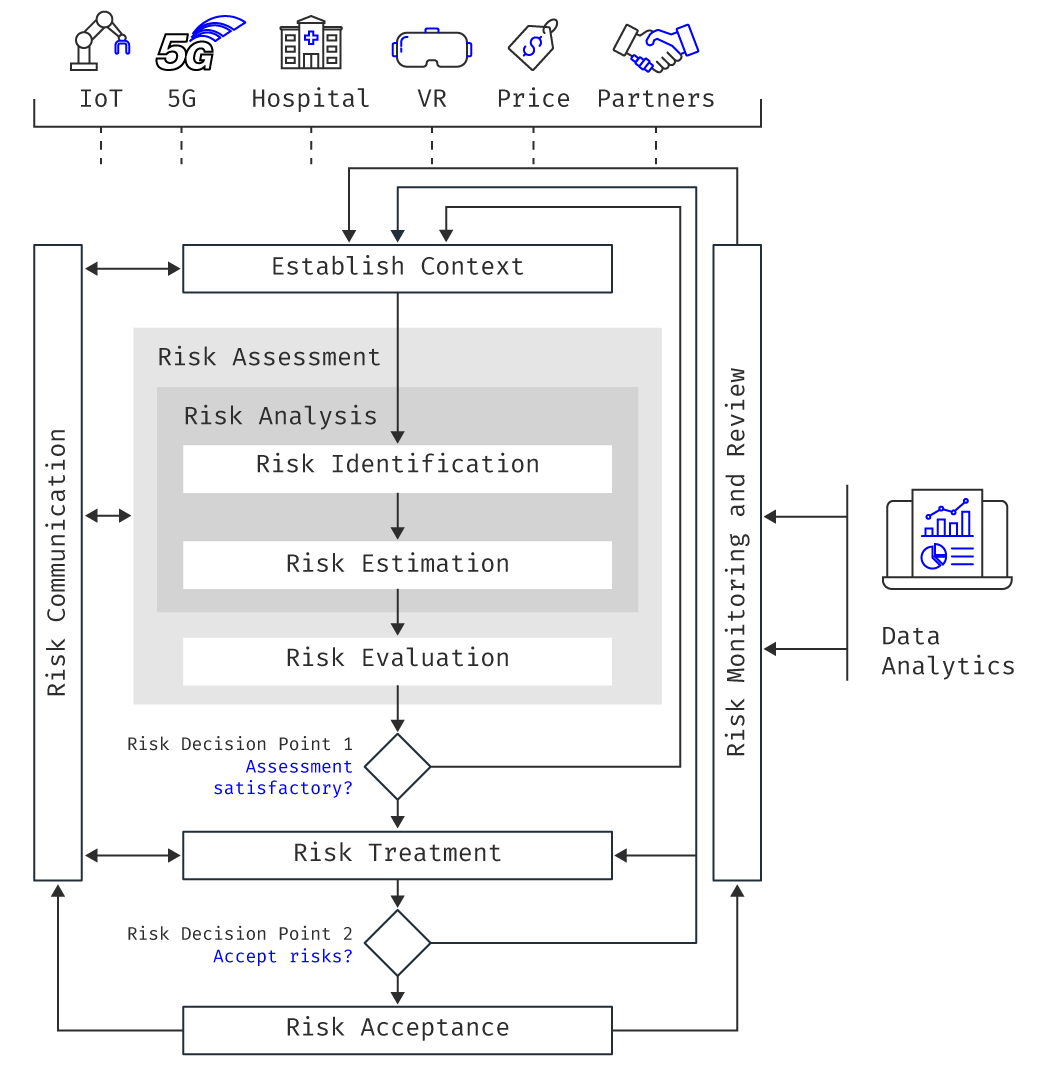

The rapid advancement of technology, including 5G architectures, IoT architectures and business models, cloud architectures, CPQ (Configure, Price, Quote) and other digital BSS tools, 5G PMN (Private Mobile Network) services, and their integration across various industry verticals, is reshaping the risk landscape for telecom companies.

Data is a valuable resource that helps us make better decisions, drive innovation, work more efficiently, and enhance various aspects of business and life. However, data alone isn't a universal solution—it has its limitations. Just having controls in place, even if they rely on data, won't be effective if they don't fit the current situation in our company. We need to regularly review, update, and adapt these controls to address the changing landscape of challenges. How often have we heard people say that managing risks with 5G technology is simply about updating the data sources for our existing controls?

Contextual Risk Assessment: Analyzing Risks in Specific Situations, Locations, Projects, and Industries

The disconnect between data analytics and risk management often stems from differences in required skill sets and the use of isolated tools in these domains. Bridging this gap is essential for a holistic approach to risk management.

To better understand the necessary skills for a cohesive team of risk management practitioners and data analytics experts to foster a modern risk management culture, let's examine the following example:

Risk management teams typically consist of individuals with diverse profiles and skills. This diversity allows them to effectively identify, assess, and mitigate various types of risks. Roles and skills commonly found in risk management teams include: Risk Analysts, Compliance Experts, Subject Matter Experts, Financial Experts, Legal Advisors, Project Managers, and Leadership roles.

Similarly, data analytics teams encompass a range of profiles and skills, including: Data Analysts, Data Scientists, Business Analysts, Data Engineers, Machine Learning Engineers, Data Architects, Data Visualization Specialists, Big Data Specialists, AI Ethics and Compliance Experts, Project Managers, and Domain Experts.

These teams collaborate to harness the power of data for informed decision-making and business improvement. However, for a truly effective risk management culture, it's essential to bridge the gap between data analytics and risk management by recognizing the value of different skill sets and tools in these domains.

Risk management typically follows a framework known as the "Three Lines of Defense" to ensure effective control and oversight of risks within an organization.

As seen above establishing multidisciplinary teams for revenue assurance then encompasses risk management and data analytics skills can indeed be a complex endeavor, especially considering technological advancements and evolving risk cultures, compounded by financial constraints. Integrating individuals with diverse expertise, ranging from traditional risk management to cutting-edge data analytics, is essential for a holistic approach to revenue assurance. However, it demands careful planning and resource allocation.

In a rapidly changing landscape, staying ahead of revenue assurance challenges requires a fusion of skills and perspectives. While technological innovations offer powerful tools for data analysis for revenue assurance purposes, it's crucial not to overlook the importance of seasoned professionals who understand the intricacies of financial processes and risk assessment.

In the realm of revenue assurance, a paradigm shift is urgently needed across all stakeholders, including practitioners, vendors, and consultancy firms. It is time to move away from viewing risk management as a separate and isolated concern, centered solely on data analysis or manual auditing. Instead, it is imperative to reimagine risk management as a value-enhancing endeavor that holds a pivotal role in shaping the strategic discourse within organizations. Whether you should leverage an internal multidisciplinary team or hire additional resources to strengthen your team is the million-dollar question.

Leveraging Interdisciplinary Teams and Skills for Effective Risk Management through Data and Analytics

Redefining risk management in this way demands a departure from rigid, traditional structures and a move toward more agile and dynamic management systems. While data and analytics certainly play a crucial role, true risk management transcends these tools. It becomes an art as much as a science, involving a holistic understanding of business operations, market dynamics, and the ever-evolving landscape of threats and opportunities.

By integrating risk management into the core of strategic decision-making, organizations can harness its potential to drive innovation, adapt to changing circumstances, and create value. It is a transformative shift that requires a collective effort from all stakeholders to foster a culture where risk management is not seen as a constraint but as an enabler of growth and resilience in an increasingly complex business environment.

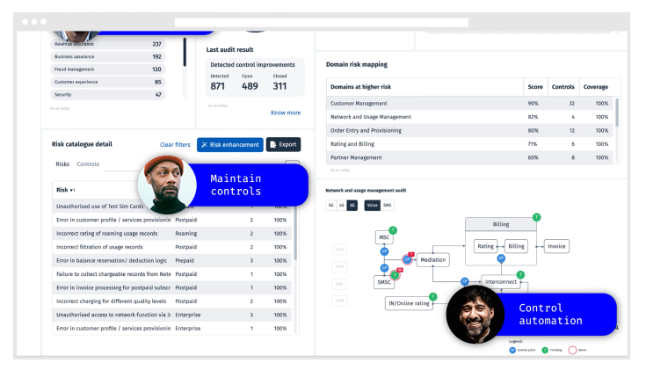

We are in the final stages of releasing our new end-to-end risk management platform, which integrates industry best practices throughout the entire risk management process, from risk identification to continuous control monitoring. Our objective is to unify all these functions within a single, centralized platform. This approach eliminates internal team silos and enhances the efficiency of our risk management efforts. While we're maintaining the highly regarded data fabric functionality our customers value, we're also expanding these capabilities to encompass the entire risk management cycle.

Give us your comments

Let us know what you thought about this article