In some businesses involving credit concession, it’s common to find Credit Scoring processes and tools. Most of the time these are incomplete, treating Credit Risk processes in a disaggregated way.

In some businesses involving credit concession, it’s common to find Credit Scoring processes and tools. Most of the time these are incomplete, treating Credit Risk processes in a disaggregated way.

Credit Scoring may involve multiple types of evaluations: Acquisition or Application Scoring, Behavior Scoring, a mix of both, or even manual handling. These can have different timings and cycles of execution and use multiple internal or external sources of information. It becomes a challenge to achieve a complete view through a single and integrated solution.

Regardless of Credit Scoring tools and processes sophistication, an accurate and up-to-date Credit Score Value is crucial in avoiding erroneous credit concession or recovery decisions with negative impacts on revenues. When the decision is too permissive, turning risk exposure higher than the defined policy, the probability of default and bad credit increases. If the decision is too restrictive, turning risk exposure lower than the accepted one, it will block the maximization of the evaluated entities’ business potential.

Credit Risk is not static, and to know at each moment the real risk in conceiving credit, it’s critical to closely follow each entity and act upon new and relevant information or credit related events. This continuous monitoring with credit risk re-evaluations keeps Credit Score Values updated with the most recent known information and behaviors. This assures the quality of data used to decide credit concession conditions (e.g., credit limits or deposits) or best scenarios and actions for credit recovery.

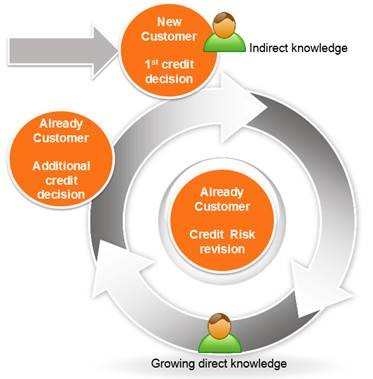

Within the life cycle of a customer, there are different events that will demand different Credit Scoring evaluations. When an entity becomes a customer with initial credit, an Acquisition Scoring (also known as Application) type of evaluation is used to decide the conditions for a possible credit concession. For current customers, the evaluation to perform is a Behavior Scoring. Acquisition scoring provides a snapshot of the entity Credit Risk at a given moment, whereas Behavior Scoring gives a continuous up-to-date Credit Risk Value.

Keep in mind that, during the entity life cycle, available information differs in type and weight. For Credit Scoring it is critical to use existent knowledge in an intelligent way, according to its actuality and reliability. When facing a new customer request, little or no direct information is available, and scoring must rely on demographic and indirect data supplied by third parties. However, when an entity is already a customer, direct and highly reliable behavior information is available, and Credit Scoring should use this knowledge to adjust an entity’s Credit Risk Value.

A complete and effective Credit Scoring solution, is the one capable of handling smoothly and consistently the different events and available data during customers’ life cycle. All Credit Scoring evaluations and manual risk handling operations, must be combined to give an accurate and up-to-date risk value and, at the same time, to tell one common and consistent story. This approach allows, not only, to know at each moment the present Credit Risk associated to each customer, but also to have access to the full story and evolution of each entity regarding Credit Scoring.

Give us your comments

Let us know what you thought about this article