— IFRS 15 compliance reporting for telecommunication companies

During the recent Apple Event, the company placed significant emphasis on Environmental, Social, and Governance (ESG) considerations, making it a central theme on their agenda and thereby paving the way for others to follow suit. Apple, as a tech giant, wields substantial influence over industry practices, setting an admirable example for its peers. The response to this focus has been remarkable—I've received an influx of webinar invitations centered around ESG topics, underscoring the heightened interest in these critical issues.

Within the realm of corporate governance and compliance, there exists a profound synergy that underpins the stability, integrity, and sustainability of organizations, irrespective of their public or private status. Governance, as the cornerstone, encompasses a structured framework of rules, practices, and organizational structures that not only guide decision-making but also instill a culture of accountability within the organization. In parallel, compliance assumes a crucial role in the organization's journey, necessitating adherence to the various laws, regulations, and industry standards that govern its operations. Compliance acts as a formidable shield against legal and regulatory risks, effectively safeguarding the organization against potential fines, lawsuits, and reputational harm.

In May 2014, the International Financial Reporting Standards (IFRS) 15, "Revenue from Contracts with Customers," was issued, ushering in a unified approach for entities to account for revenue arising from customer contracts, a regulation equally applicable to companies operating in the telecommunications sector. IFRS 15 supersedes existing revenue recognition standards, including IAS 18 Revenue, IAS 11 Construction Contracts, and their related interpretations.

The primary objective of IFRS 15 is to establish principles that entities should apply when reporting information to financial statement users. This information pertains to the nature, amount, timing, and uncertainty of revenue and cash flows derived from customer contracts. The application of this standard has been mandatory for annual reporting periods commencing from 1 January 2018 onwards.

Whereas previously, IFRS allowed significant room for judgment in devising and applying revenue recognition policies and practices, the revised IFRS is more prescriptive in many areas relevant to the telecommunications industry. Implementing these new rules may lead to substantial changes in the profile of revenue recognition and, in some cases, cost recognition.

In particular, telecommunications companies will need to consider the following:

- The impact of the new guidance on revenue allocation to all goods and services within contracts.

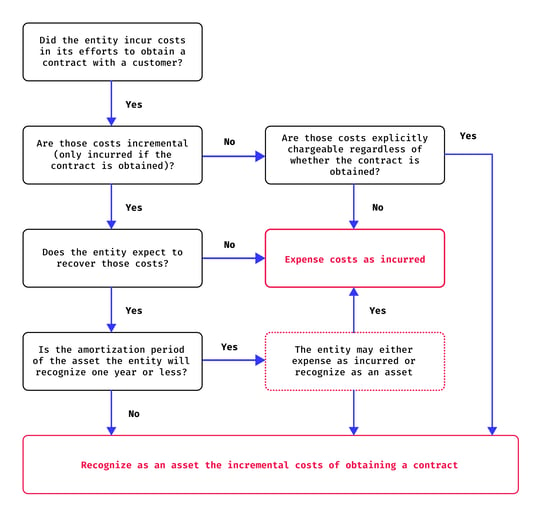

- Whether specific costs related to contract acquisition should be capitalized.

- The feasibility of applying the portfolio approach to groups of contracts.

- The necessity of adjusting revenue for the time value of money.

- The appropriate accounting treatment for contract modifications.

Currently, telecom companies account for revenue differently. Some companies treated the value of mobile handsets as a cost of acquiring the customer and recognize revenue based on the sale of monthly plans. Under IFRS 15, telecom companies are required to identify the performance obligations included in the bundled contract (i.e., handset, call minutes, and data packages) and, accordingly, allocate the transaction price to each performance obligation based on an acceptable method. As such, the amount of revenue to be recognized under IFRS 15 will be significantly different than that recognized with the current accounting standards.

Example – Incremental costs of obtaining a contract in the Telecommunications industry

A service provider offers wireless mobile phones and various telecommunications service packages through a physical retail outlet. Within a specific month, the retail store's sales representatives successfully enlisted 120 customers for two-year service agreements. In addition to their regular salaries, Telecommunications compensates its sales agents with commissions for each service contract sale. In that particular month, the total salaries disbursed to the sales agents amounted to $12,000, while commissions reached $2,400. Furthermore, the retail store incurred advertising expenses totaling $2,000 during the same month.

The sole expenses eligible to be considered incremental costs associated with contract acquisition are the commissions disbursed to the sales agents. These commissions represent expenses incurred by Telecommunications solely due to the acquisition of contracts; these costs would not have materialized if the contracts had not been obtained. Telecommunications should log these costs as assets, provided they are expected to be recoverable.

In contrast, all other expenses should be recognized as incurred. The salaries of the sales agents and the advertising expenditures are costs that Telecommunications would have had regardless of whether or not it secured the customer contracts.

For those who, like me, have spent years working with revenue assurance software, the concept of accounting for revenue arising from customer contracts is not a novel one. To companies that have robust revenue assurance systems in place, compliance with IFRS 15 might seem like a straightforward task, right? Well, it's not that simple.

Engaging in data analytics represents a powerfull tool for businesses striving to extract valuable insights from their data, optimize their operations, and enhance their decision-making processes. However, it is crucial to recognize that conducting data analytics does not automatically guarantee alignment with regulatory and compliance reporting requirements.

Data analytics primarily focuses on uncovering trends, patterns, and opportunities within datasets to drive improvements and operational efficiencies. In contrast, regulatory and compliance reporting centers on ensuring that the organization adheres meticulously to specific rules, regulations, and industry standards. While these two objectives are interconnected, they remain distinct in their focus and purpose. Depending on a telecom operator's revenue assurance maturity, the full automation of the end-to-end revenue lifecycle can make IFRS compliance easier with the right amount of automation where you are in total control.

![231004_Mobileum_Screens_2[21]](https://blog.mobileum.com/hs-fs/hubfs/01.%20Mobileum/05.%20Blog/2023%2010%20Revenue%20Assurance%20and%20IFRS15/231004_Mobileum_Screens_2%5B21%5D.png?width=747&height=355&name=231004_Mobileum_Screens_2%5B21%5D.png)

Compliance and governance focus on establishing rules and ensuring ethical behavior within an organization. In contrast, data analytics is both a tool and methodology used to extract actionable insights from data. While these disciplines have distinct objectives, it's worth noting that data analytics can be employed to support compliance and governance efforts.

Data and analytics have become ubiquitous across enterprises, influencing various aspects of business processes and industries. They play a crucial role in addressing global disruptions and assisting individuals in achieving their financial objectives. Leaders in data and analytics, including revenue assurance practitioners, should learn how to leverage their tools to generate tangible business value like the implementation of IFRS15 reporting use cases. This approach will enable them to enhance their significance within their organizations and contribute to their growth.

A pertinent question to consider is how many revenue assurance practitioners have incorporated IFRS15 controls into their revenue assurance tools and reporting processes.

Give us your comments

Let us know what you thought about this article